The Finns Fishery Corp’s vision for a state-of-the-art indoor fish farm and educational campus in Pinckney Village is supported by a robust $8 million capital funding initiative. This plan outlines a strategy to achieve payback of this capital within five years, building upon the allocated budget and a projected $1 million gross profit by Year 2.

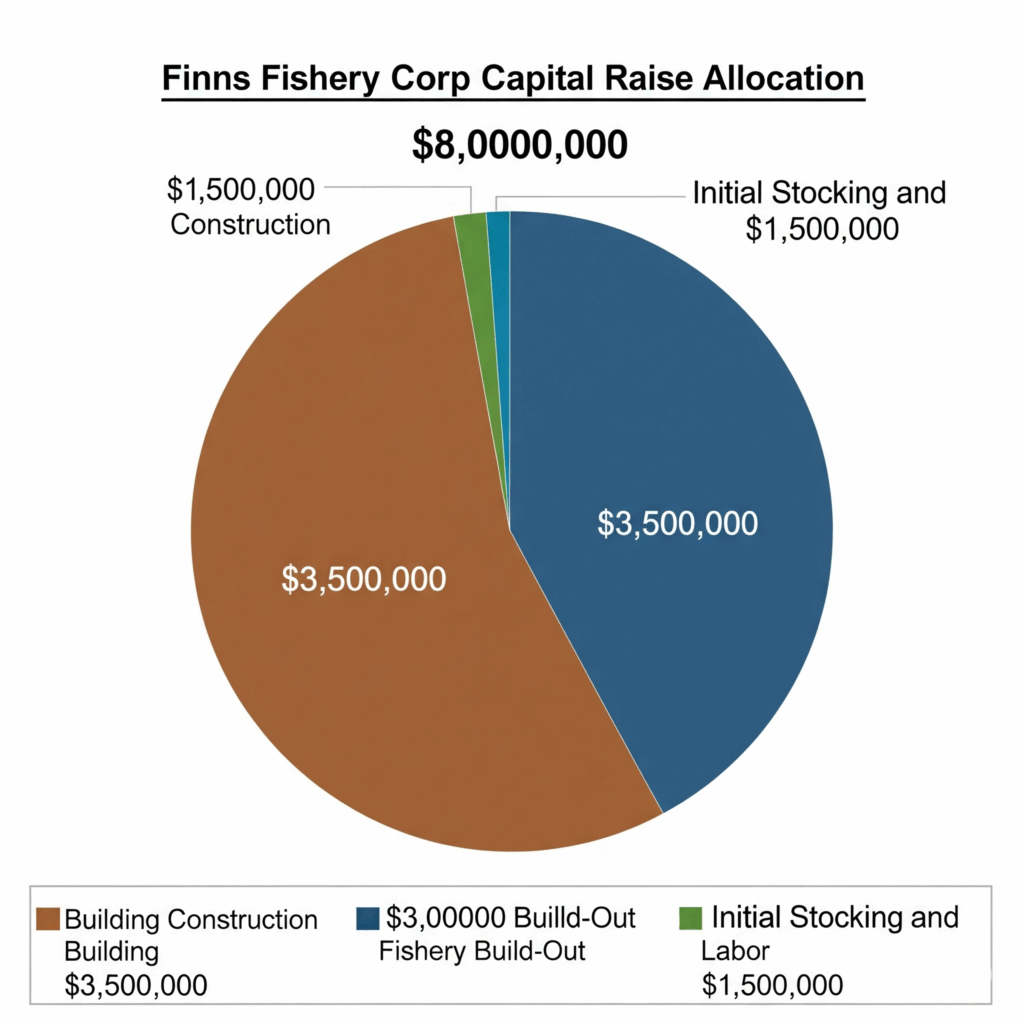

Capital Funding Allocation:

The $8,000,000 capital funding is designated as follows:

- Building Construction/Acquisition: $3,500,000

- Fishery Build-out (RAS Equipment, Tanks, Systems): $3,000,000

- Initial Stocking, Startup Labor & Business Management (Initial Operating Capital): $1,500,000

Total Capital Invested: $8,000,000

Key Assumptions for Payback Plan: - Primary Fish Species: For this plan, we will consider Barramundi (Asian Sea Bass) due to its suitability for Recirculating Aquaculture Systems (RAS), relatively fast growth rate, and strong demand in restaurant and retail markets.

- Average Wholesale Price: An assumed average wholesale price of $7.00 per pound for processed Barramundi. (Note: Actual prices fluctuate based on market conditions, size, and form).

- Gross Profit Definition: For the purpose of this payback plan, “Gross Profit” represents the cash generated from sales after deducting direct variable production costs (e.g., feed, utilities directly related to production, direct farm labor, initial fish stock replacement costs). This is the cash flow available to contribute towards the payback of the initial capital investment. It excludes fixed overheads, depreciation, and interest payments (assuming the $8M is equity/grant funding without traditional debt service payments for this model).

- Year 1 Ramp-up: The first year of operation will involve significant ramp-up, optimization, and achieving stable production cycles. Therefore, a conservative or break-even gross profit is assumed.

- Year 2 Target: The plan incorporates the user-stated target of $1,000,000 gross profit by Year 2.

- Growth Trajectory: Post-Year 2, the facility is assumed to benefit from optimized processes, established market channels, and potential expansion within the 20,000 sq ft footprint, leading to increased output and profitability.

5-Year Capital Payback Plan

| Year | Annual Gross Profit | Cumulative Gross Profit | Remaining Capital to Payback | Implied Annual Production (lbs)* | Implied Annual Revenue** |

|—|—|—|—|—|—|

| Year 1 | $0 | $0 | $8,000,000 | (Ramp-up Phase) | (Ramp-up Phase) |

| Year 2 | $1,000,000 | $1,000,000 | $7,000,000 | ~408,163 lbs | ~$2,857,143 |

| Year 3 | $2,000,000 | $3,000,000 | $5,000,000 | ~816,327 lbs | ~$5,714,286 |

| Year 4 | $2,500,000 | $5,500,000 | $2,500,000 | ~1,020,408 lbs | ~$7,142,857 |

| Year 5 | $2,500,000 | $8,000,000 | $0 | ~1,020,408 lbs | ~$7,142,857 | - Implied Annual Production (lbs) is calculated assuming a target gross profit margin of ~35% of revenue. Production then derived from Revenue / $7.00/lb. This margin is an estimate for well-managed RAS.

- Implied Annual Revenue is calculated as Annual Gross Profit / 35% Gross Profit Margin.

Explanation of Payback Strategy: - Year 1 (Foundation & Ramp-up): This year is dedicated to completing the build-out, establishing stable biological and operational systems, stocking the initial fish, and training staff. Cash flow generated might be minimal or even negative as production scales up and initial operating capital ($1.5M) is utilized. The focus is on perfecting processes rather than maximizing immediate profit.

- Year 2 (Achieving Profitability): With systems optimized, a steady production cycle is established, allowing Finns Fishery Corp to achieve its target of $1,000,000 in gross profit. This demonstrates operational efficiency and market acceptance.

- Years 3-5 (Accelerated Payback): The significant increase in gross profit from Year 3 onwards (averaging $2.33 million annually) is predicated on:

- Full Production Capacity: Reaching the optimal stocking densities and fastest grow-out cycles the 20,000 sq ft state-of-the-art facility can sustain. An implied production of over 1 million lbs by Year 4/5 for 20,000 sq ft suggests a high-density, very efficient RAS operation (50+ lbs/sq ft/year), which is ambitious but potentially achievable with the “state-of-the-art” designation.

- Market Penetration: Expanding sales channels to fully leverage restaurant and retail demand, potentially including direct-to-consumer sales for higher margins.

- Operational Efficiencies: Continued fine-tuning of feed conversion ratios, energy consumption, and labor management to maximize profitability per pound of fish.

- High-Value Product: Selling Barramundi to premium markets (restaurants, specialized retail) to maintain the assumed average wholesale price.

This 5-year plan demonstrates a viable pathway to repay the $8 million capital funding, emphasizing the critical transition from initial investment and ramp-up to sustained, high-volume, and profitable operation. Success will hinge on meticulous execution of the RAS design, rigorous operational management, and effective market strategies.